Astral Recurring Invoices - Help:

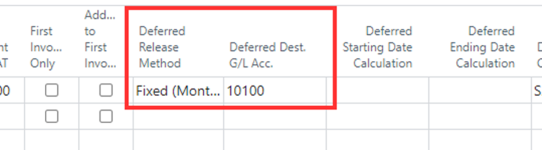

The Recurring Invoice Template can also be configured to generate Sales Invoices that post Deferred Entries. Select the “Deferred Revenue” account in the 'Recurred Invoice Template' line and specify the 'Deferred Release Method' and 'Deferred Dest. G/L Acc.' as per the instructions for creating a Deferred Sales Invoice.

Figure 1 | Specify Fields

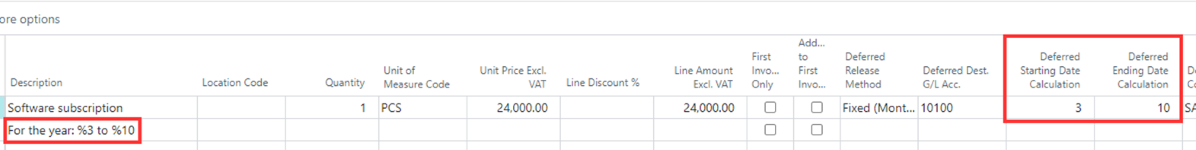

However, rather than specifying a 'Deferred Starting Date' and 'Deferred Ending Date', a 'Deferred Starting Date Calculation' and 'Deferred Ending Date Calculation' is specified instead, and these fields would typically correlate to the 'Date Placeholders' specified on the Comment lines for descriptive purposes.

Figure 2 | Calculation Correlation

On generating the Sales Invoice from the Recurring Sales Invoice Template, the process will use the Date Placeholders and the Sales Invoice 'Document Date' to calculate and validate the 'Deferred Starting Date' and 'Deferred Ending Date' needed to allow the Sales Invoice to be posted.